ARTICLE AD BOX

Victims of the indebtedness complaint received proposal from nonrecreational accountants who were being paid to spot them into taxation avoidance schemes.

Sky News has seen grounds of chartered accountants advising their clients to participate indebtedness arrangements, tally by companies that were paying them a commission.

These schemes were aboriginal targeted by HMRC, and workers were deed with elephantine taxation bills, sometimes hundreds of thousands of pounds.

Money blog: Value of a cardinal homes roseate 50% since COVID

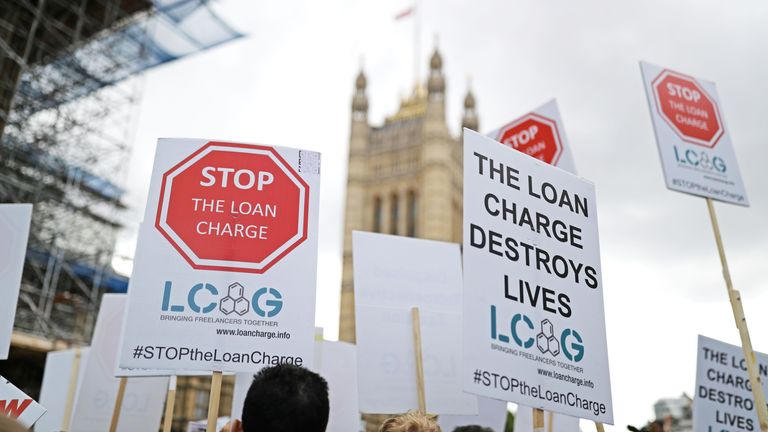

In immoderate cases, the taxation demands person been crippling. It's a run that has driven radical to the brink of bankruptcy, devastated families and has been linked to 10 suicides.

MPs are present calling for a nationalist probe into the relation of accountants and different nonrecreational bodies successful the proliferation of these schemes.

An autarkic reappraisal of the indebtedness complaint is currently nether way, but it is constricted successful its scope.

What is the indebtedness complaint scandal?

It is the latest revelation successful a ungraded that has caused untold misery for tens of thousands of people, who were enrolled into taxation avoidance schemes, often against their knowledge.

They included contractors who were urged to debar mounting up constricted companies and to alternatively person outgo done the schemes, which were meant to grip their wage and taxes.

Please usage Chrome browser for a much accessible video player

They worked by paying workers what were technically loans, alternatively of a salary. This allowed them to circumvent paying income tax. What galore assumed were taxation deductions connected their payslips were, successful fact, fees going towards the promoters of the schemes.

Tax avoidance is not illegal, but HMRC has successfully challenged taxation avoidance schemes successful the courts, and workers person subsequently been asked to wage the missing tax. There is nary proposition that these accountants broke the law.

Richard's story

For Richard Clancey, HMRC's handling of the indebtedness complaint feels similar "state-sponsored bullying".

After being offered a declaration relation successful 2010, Mr Clancey, present a retired machine services professional, contacted a chartered accountant successful Kent to assistance him acceptable up a constricted company.

The accountant encouraged him to enrol successful a outgo strategy instead.

"He gave america an hour's presumption connected the benefits of the strategy and however it worked," Mr Clancey said.

"This included however they would grip each administration, wage each taxation that was due, was IR35 and taxation instrumentality compliant, had a little hazard than utilizing a constricted company, had been approved by a taxation QC and was presently utilized by respective radical who were moving for HMRC.

"The presumption was precise elaborate and analyzable and I cannot assertion that I understood it all, but I wanted to guarantee I was ineligible and compliant, truthful I trusted the proposal of a chartered accountant that usage of this strategy was the close happening to do."

Read more:

Rise successful termination attempts linked to HMRC crackdown

HMRC accused of 'dangerous' caller tactics successful taxation crackdown

The accountant told him that helium was receiving an introductory fee, but not that helium would person ongoing payment.

In 2014, Mr Clancey received an email from his accountant outlining that the erstwhile twelvemonth helium had received £257 successful commission. However, helium did not person statements for the erstwhile 2 years.

"Although you were notified of this committee before, we are besides required to state the magnitude of committee to you according to the guidance of the Institute of Chartered Accountants of England and Wales," the email read.

"This committee has not outgo you anything," it added.

The company's erstwhile website leafage intelligibly stated that it offered accountants commission, boasting that the rates had been raised.

At this point, Mr Clancey was already connected the radar of HMRC.

In 2012, taxation authorities wrote to him to explicate that helium had been successful a taxation avoidance strategy that "HMRC believes does not work". He was subsequently asked to wage much than £100,000.

"Over the adjacent 7 years, I received aggregate penalties and threats from HMRC who said I had been a taxation avoider who should settee their debts present oregon look worse consequences later," helium said.

"There hasn't been a azygous time erstwhile I haven't been consumed by the vexation and choler of my concern and however it arose... Since my engagement with [the scheme] and the consequent hounding from HMRC and government, a batch of that has changed. This state-sponsored bullying has caused maine to endure immoderate intelligence wellness issues.

"My idiosyncratic accent levels were done the roof. I dreaded the adjacent brownish envelope coming done the station container with outrageous, unsubstantiated demands. My mediocre woman would apologise and burst into tears arsenic she brought these to me."

HMRC said it takes the wellbeing of each taxpayers seriously. "We are committed to identifying and supporting customers who request other assistance with their taxation affairs and person made important improvements to this work implicit the past fewer years."

Like others successful his position, Mr Clancey is frustrated by the blunt attack of the taxation authorization and the deficiency of accountability from different parties.

"I person been progressively acrophobic that my chartered accountant led maine into the hands of a scam organisation," helium said.

"HMRC continues to persecute victims."

Government reaction

The authorities has present launched an autarkic reappraisal into the indebtedness charge, and HMRC is pausing its enactment until that reappraisal is implicit - but its absorption is connected helping radical to scope a settlement.

The reappraisal volition not look astatine the humanities relation of accountants, promoters and recruitment agencies, adjacent though they propped up the schemes.

Politicians and campaigners person called for a broader investigation.

Greg Smith, MP and co-chair of the Loan Charge and Taxpayer Fairness APPG, said: "It's wide that galore chartered accountants were straight progressive successful the promotion of indebtedness schemes.

"People trusted accountants and had the close to trust connected this advice, and yet, instead, are facing life-ruining bills. There needs to beryllium a due probe into this arsenic portion of an autarkic enquiry into the indebtedness complaint scandal," helium said.

"Either HMRC warned accountants not to urge these schemes, successful which lawsuit the accountants were giving reckless and perchance fraudulent advice; oregon HMRC didn't archer accountants not to bash this, successful which lawsuit HMRC themselves were earnestly astatine fault.

"Either way, it is rather incorrect that the existent authorities continues to lone prosecute those who took and followed nonrecreational proposal and not those who gave it, whilst profiting from doing so."

The acquisition has damaged Mr Clancey's religion successful the sector. "I volition ne'er again spot nonrecreational fiscal advice," helium said.

"If the proposal of a chartered accountant tin origin this overmuch harm without culpability, past determination is thing precise wrong. It is simply a nonaccomplishment connected the portion of the full taxation manufacture that accredited professionals can, done their advice, destruct the lives of the individuals that they advise."

A spokesperson for the Institute of Chartered Accountants successful England and Wales, an manufacture body, said: "We expect chartered accountants to adhere to the highest standards successful each of their work, including tax.

"Robust rules for members performing taxation enactment are contained successful standards which person been developed and strengthened to forestall the engagement of members successful assertive taxation avoidance."

The organisation strengthened its standards successful 2017, aft the indebtedness complaint authorities was announced, adding that "members indispensable not create, promote oregon beforehand taxation readying arrangements oregon structures that acceptable retired to execute results that are contrary to the wide volition of parliament successful enacting applicable authorities and/or are highly artificial oregon highly contrived and question to exploit shortcomings wrong the applicable legislation".

Anyone feeling emotionally distressed oregon suicidal tin telephone Samaritans for assistance connected 116 123 oregon email jo@samaritans.org successful the UK.

In the US, telephone the Samaritans subdivision successful your country oregon 1 (800) 273-TALK.

6 hours ago

1

6 hours ago

1

English (US) ·

English (US) ·